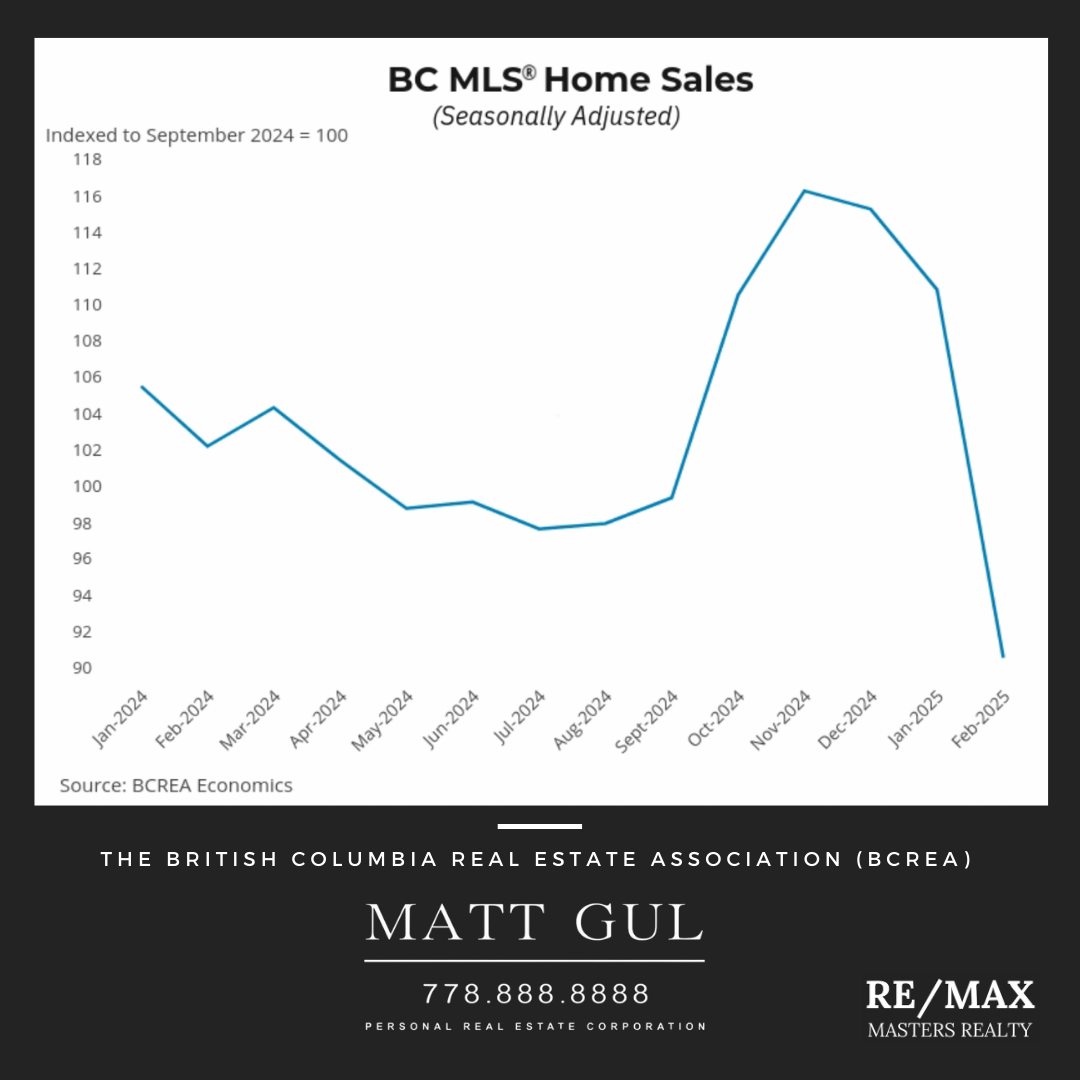

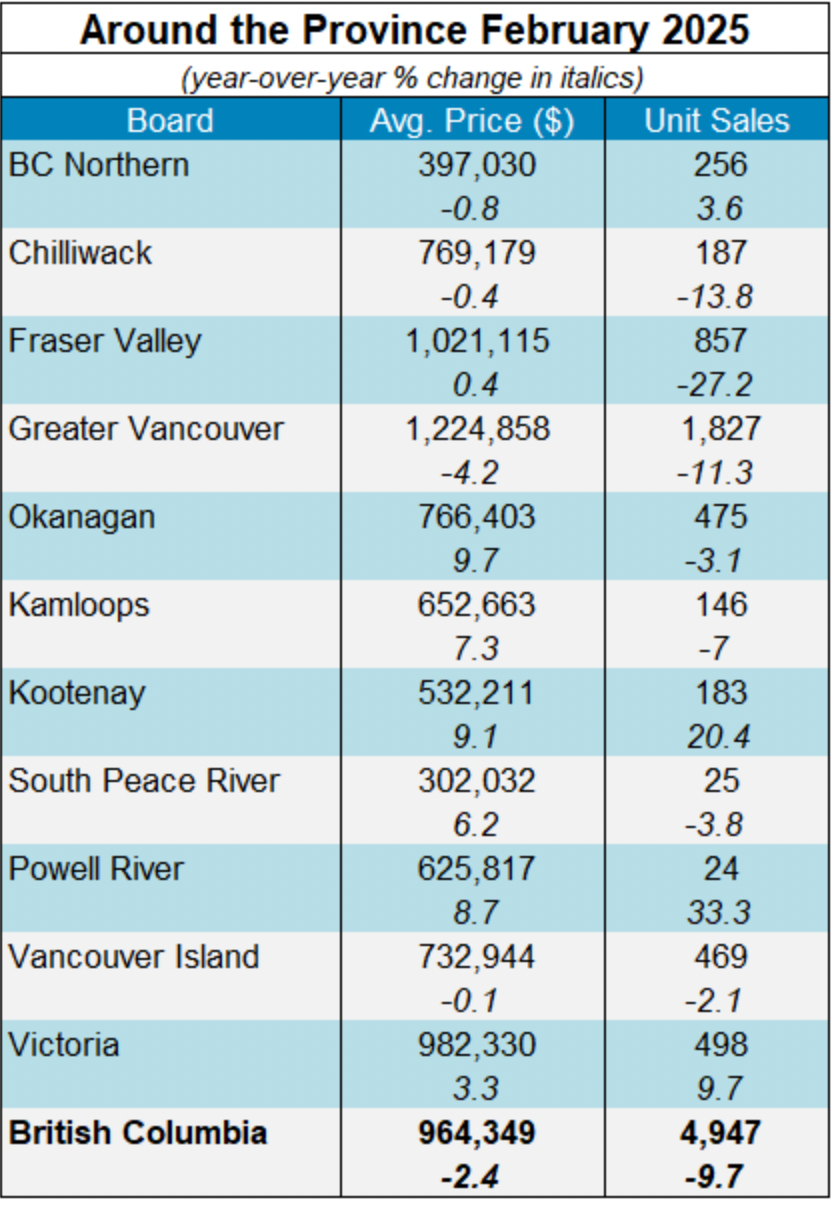

IN FEBRUARY 2025, 4,947 RESIDENTIAL UNIT SALES WERE RECORDED IN THE MULTIPLE LISTING SERVICE® SYSTEMS, DOWN 9.7 PER CENT FROM FEBRUARY 2024. ACCORDING TO BCREA ECONOMISTS, MARKET ACTIVITY DURING THE MONTH WAS HAMPERED BY UNCERTAINTY SURROUNDING UNITED STATES TARIFFS ON CANADIAN GOODS.

Canadian Real Estate Prices Rise, Sales Make The Sharpest Drop In Years

The total sales dollar volume was $4.8 billion, an 11.8 per cent decrease from the same time the previous year. BC MLS® unit sales were 28 per cent lower than the ten-year February average.

“After several months of growing momentum, market activity was hampered in February by the uncertainty surrounding tariffs,” said BCREA Chief Economist Brendon Ogmundson. “Apprehension from prospective buyers will continue amidst this unfortunate trade war but may be somewhat tempered by lower interest rates on the horizon."

Year-to-date, BC residential sales dollar volume is down 4.5 per cent to $8.8 billion, compared with the same period in 2024. Residential unit sales are down 2.8 per cent year-over-year at 9,175 units, while the average MLS® residential price is also down 1.8 per cent to $958,366

-

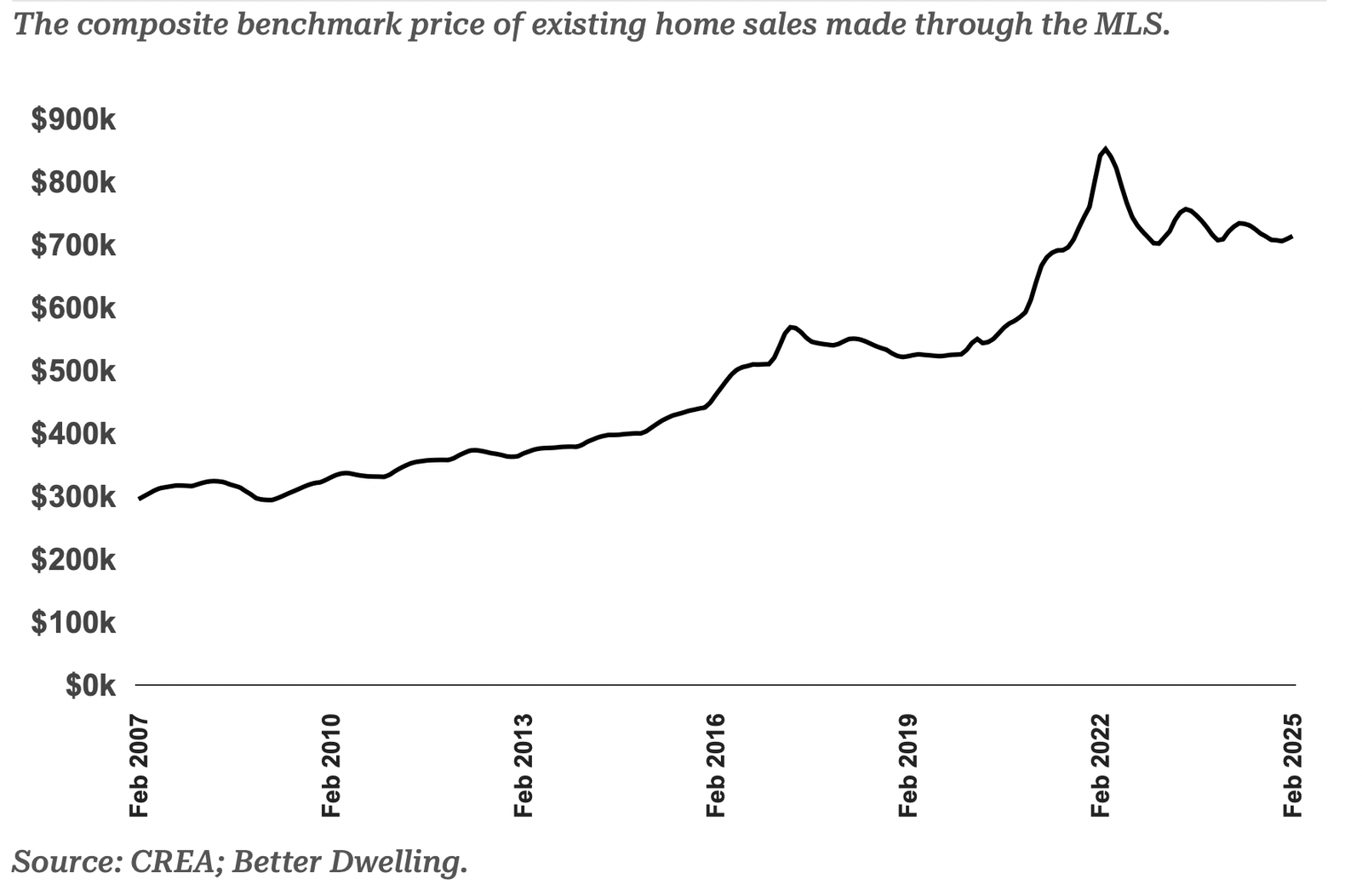

Canadian home price growth continues to accelerate despite further demand erosion. Canadian Real Estate Association (CREA) data shows home prices jumped in February. The increase was accompanied by sales making the sharpest drop in years—easing inventory pressures even further. That’s not how this traditionally works.

Canadian existing home prices continued their march upward last month. The price of a benchmark (or typical) home climbed 0.6% (+$4,400) to $713,700 in February. Home prices are 1.0% (-$6,900) lower than last year.

Annual growth moved deeper into loss territory, but it was due to a shifting 12-month window. The downward pressure this time last year has begun to roll off, obfuscating the recent acceleration. More recent data shows short-term acceleration, with the 3-month (annualized) rate rising significantly higher than the annual rate. It also happens to be much higher than it was this time last year—when there were no tariff threats, higher population growth, and even more sales.

Canadian real estate demand continues to fade. CREA specifically notes that seasonally adjusted sales made a monthly drop of 9.7% in February, and it was the sharpest drop since May 2022—back when rate hikes first began. The industry professional group attributed this to “tariff uncertainty,” but it’s worth recalling this uncertainty pushed prices higher.

Unadjusted annual growth in February (-10.4%) shows home sales slowing at a rate similar to pre-trade war announcement. Buyers in the market also paid more, most likely believing that falling rates would push home prices higher in March.