March 12

The Bank of Canada (BoC) has cut its benchmark interest rate by 25 basis points to 2.75%, marking the seventh consecutive reduction since mid-2024.

This decision comes amid growing economic uncertainty, primarily due to U.S.-imposed tariffs and potential trade conflicts. The move is aimed at mitigating financial pressures on Canadians, particularly mortgage holders and homebuyers.

Economic Justification

Canada’s economic growth showed resilience in late 2024 but is now expected to slow due to trade tensions with the U.S. Inflation remains close to the BoC’s 2% target, but the end of temporary tax breaks is expected to push inflation to 2.5% by March. Business and consumer confidence have been shaken, causing a drop in spending and investment.

Impact on Homeowners and Buyers

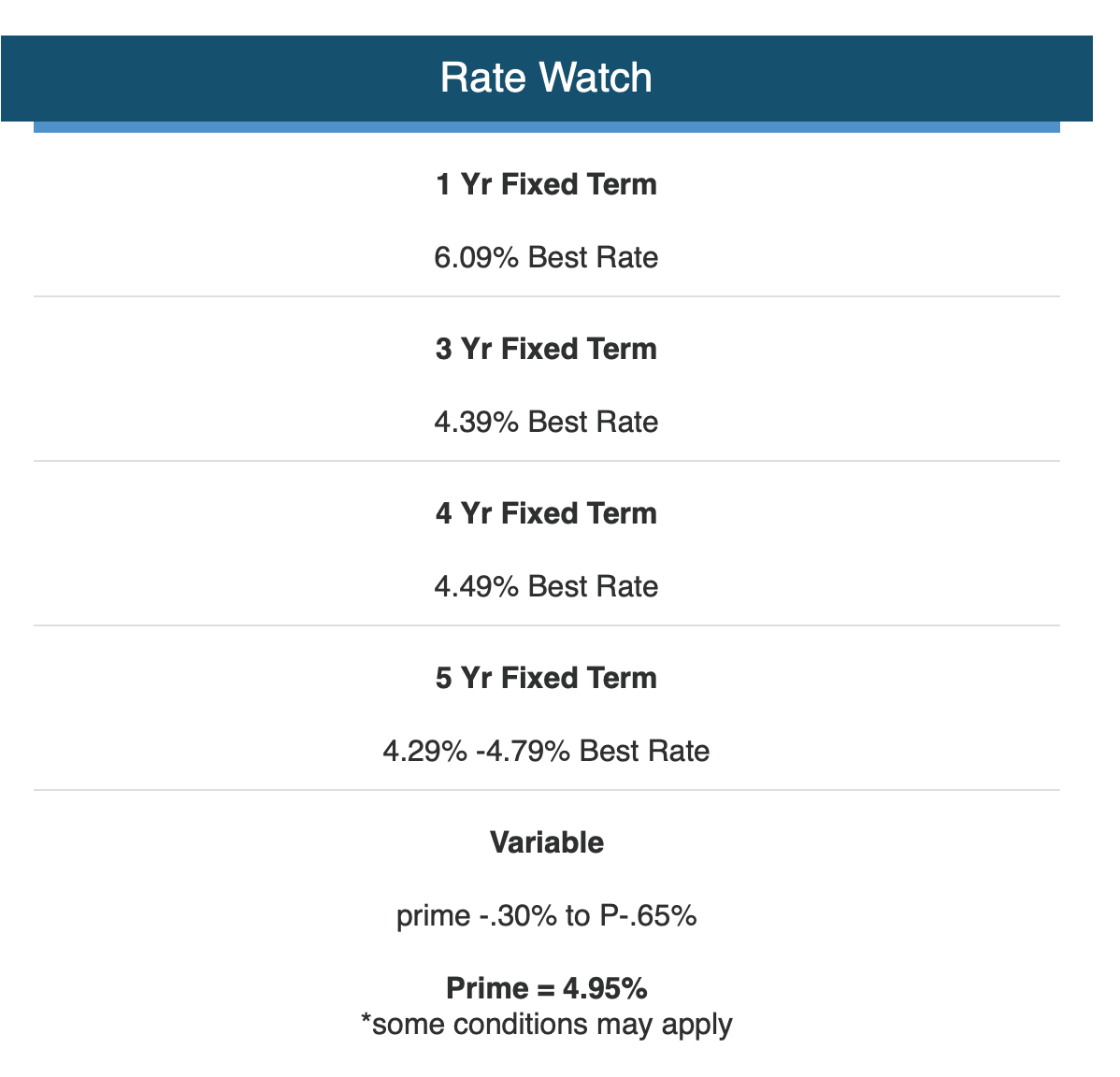

Lower rates will reduce borrowing costs, making variable-rate mortgages and Home Equity Lines of Credit (HELOCs) more affordable. Increased affordability could drive demand in the housing market, potentially raising home prices.

Fixed-rate mortgage holders may not see an immediate impact, but bond yields may adjust over time lowering rates.

What’s Next?

More rate cuts could follow in 2025 if economic conditions deteriorate. Some analysts predict the BoC’s rate could fall to 2.25% by mid-year. The BoC acknowledges that while monetary policy can help cushion the impact of trade disruptions, it cannot fully offset them.

January 29th, 2025

A new year starts with a rate reduction!

The Bank of Canada Cuts Rates Again – But Trade War Risks Loom Large

The Bank of Canada (BoC) has lowered its benchmark rate by 25 basis points to 3.00%, marking the sixth consecutive rate cut amid signs of slowing economic growth and moderating inflation. While inflation remains near the central bank’s 2% target, concerns over a potential trade war with the U.S. have clouded the economic outlook.

The biggest wildcard? U.S. President Donald Trump’s threat to impose a 25% tariff on all Canadian imports, which could take effect as early as February 1. If enacted, these tariffs would significantly disrupt trade, potentially pushing Canada into a recession while also driving up inflation due to higher import costs.

The BoC has modeled several scenarios, with estimates suggesting that a full-blown trade conflict could shave up to 3 percentage points off GDP growth in the first year. In response, the Bank may be forced to cut rates more aggressively throughout 2025, possibly lowering the benchmark rate to 2.25% or lower before year-end.

What This Means for Real Estate and Borrowers

With rates dropping further, homebuyers gain more purchasing power, likely fueling demand and putting upward pressure on home prices. If you’re considering buying, refinancing, or selling, now is a crucial time to assess your options.

The BoC has signaled it will continue adjusting rates as needed to keep the economy stable, but a prolonged trade war could change the game completely.

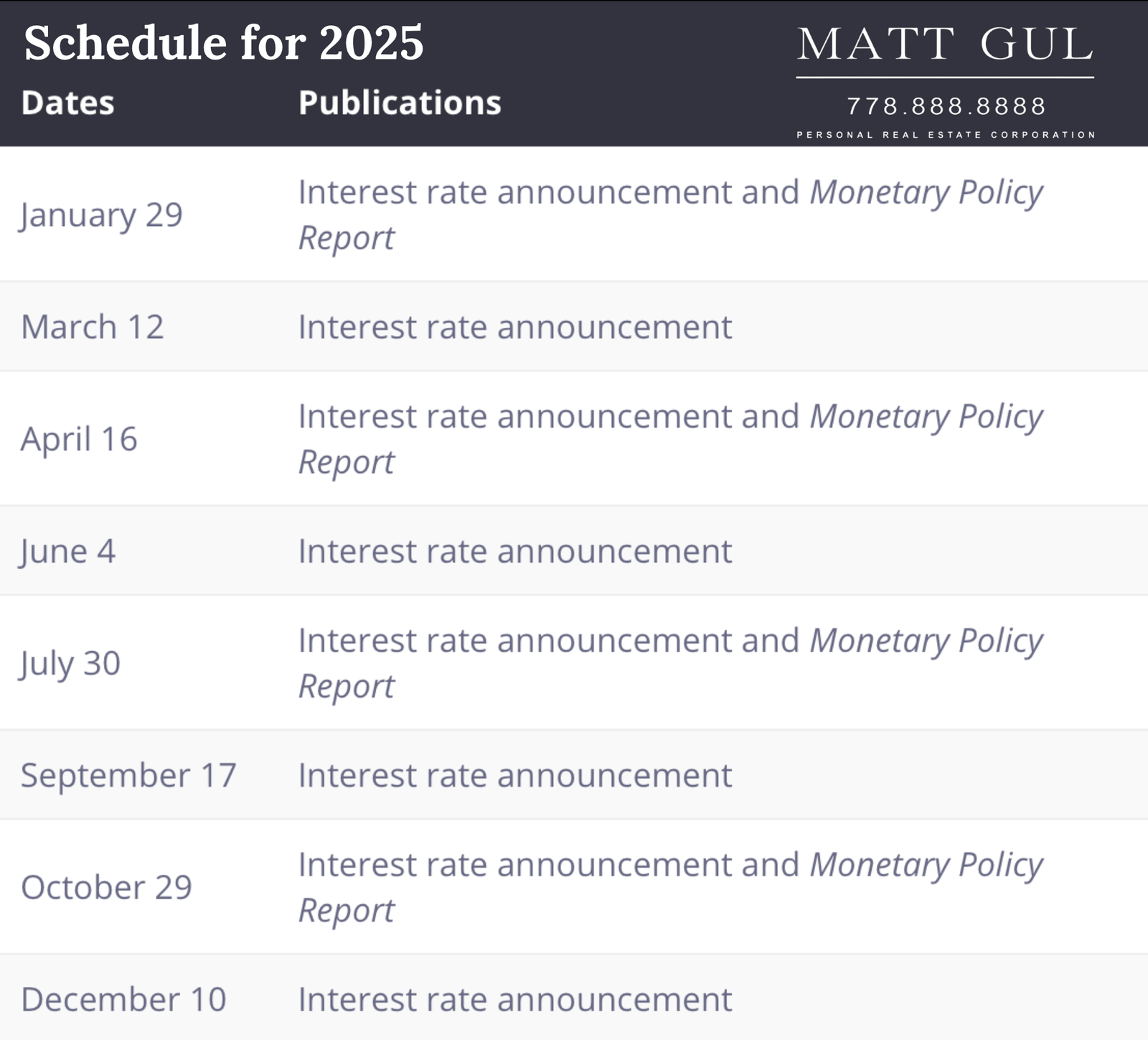

Bank of Canada Interest Rate Announcement Dates / 加拿大央行利率公佈日期

- January 29 -0.25

- March 12 -0.25

- April 16

- June 4

- July 30

- September 17

- October 29

- December 10

If you are interested in selling or purchasing a property, please contact Matt Gul, one of West Vancouver's top Realtors at 778-888-8888, for Mortgage Advice, please contact Dave Bruynesteyn at 604-315-3283 and mention that you've been referred by Matt Gul.

***For Previous Bank of Canada Interest Rate Announcements, Please Click Here***