Steady fall market anticipated in majority of regions across Canadian housing market!

According to the RE/MAX 2024 Fall Housing Market Outlook Report, the long-anticipated decline in interest rates is expected to have a ripple effect on the market this fall, with consumer confidence rising and with average sale prices across all housing types expected to increase between one and six per cent in most regions by year’s end.

2024 Price Outlook: National residential sale price expected to increase in 76% of regions this fall.

2024 Sales Outlook: One-third of housing markets analyzed are expected to be seller’s markets this fall.

"The fall market is usually a good early indicator for activity as we look ahead to early 2025, and we’re headed toward more healthy territory. With interest rates starting to ease, buyers are beginning to come off the sidelines,” says Christopher Alexander, President, RE/MAX Canada. “That’s not to say the fall market will be in full swing according to historic standards. Consumers will drive that trend, so we’ll need to see a bigger move by the Bank of Canada for that to happen.”

Consumer Sentiments Going Into the Fall Market

It seems that even the mere prospect of lower rates has boosted confidence among first-time homebuyers, with one-quarter of Canadians (25 per cent) actively saving for a home purchase and confident they will be able to buy soon (with the majority being younger Millennials and Gen Zs aged 18-24, at 35 per cent).

On the flipside, dropping interest rates now may prove too little, too late for some current homeowners, with 14 per cent saying they need to renew their mortgage soon, and with the current higher interest rate, they may need to sell their home. When it comes to financial savings, the Leger survey revealed that while a home purchase is listed among the top three priorities for 25 per cent of Canadians, it has taken a back seat to day-to-day expenses such as utilities and food (58 per cent), and travel (45 per cent).

In the search for affordability, one-quarter of Canadians say that they are considering moving to another country (28 per cent) and 25 per cent say they are reconsidering whether to have children or start a family due to housing affordability challenges.

“Despite some consumer confidence starting to return to the market this season, the reality is Canadians are still grappling with some serious housing affordability challenges rooted in lack of supply. Yes, borrowing is becoming less expensive, but this won’t make housing affordable in the long run,” says Alexander. “Markets ebb and flow, and as buyers re-enter the market and absorb inventory, we’ll see more upward pressure on price.

“Ultimately, for the long-term health of Canada’s housing market, we need a national housing strategy developed in collaboration between all levels of government, that’s more strategic and visionary in how we can use existing lands and real estate to boost supply. In the meantime, buyers would be wise to work with an experienced real estate agent to help navigate those cyclical market ups and downs that often accompany this push and pull of supply and demand.”

According to RE/MAX brokers’ insights, 33 per cent of housing markets are expected to be seller’s markets, but this may shift as competition increases and market conditions evolve.

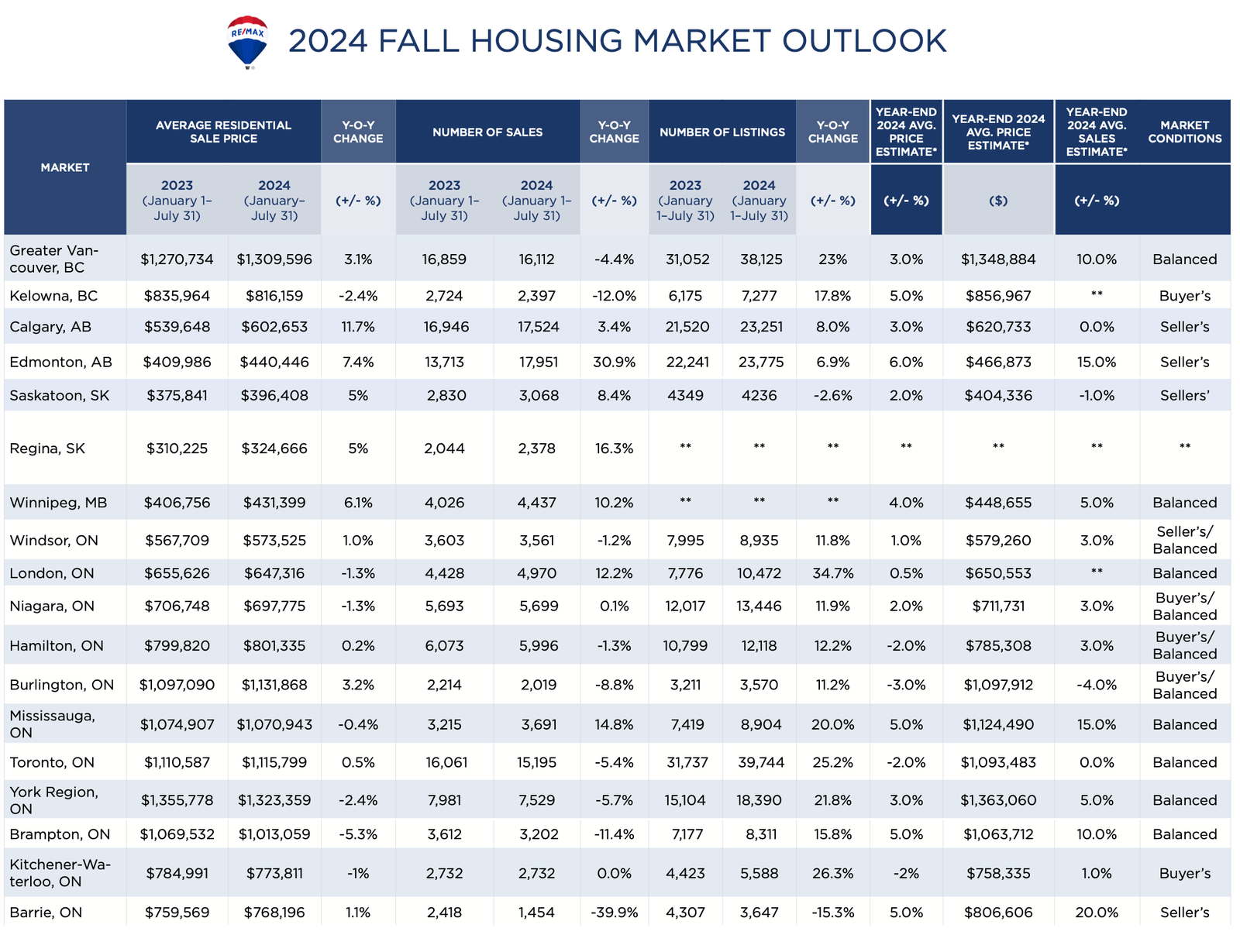

82 per cent or regions surveyed saw the number of listings increase between 2.3 and 34.7 per cent between January and July (2023 – 2024). The number of sale transactions also increased between 3.1 and 7.4 per cent in Atlantic Canada, 3.4 to 30.9 per cent in Western Canada, and between 0.6 and 14.8 per cent in Ontario, except for some larger Ontario markets like Toronto, Brampton, Durham Region, Mississauga, Peterborough, and York Region, where sales trended downward.

Greater Vancouver Area 2024 Fall Housing Market at a Glance

The average sale price in the Greater Vancouver housing market has increased by 3.1 per cent year-over-year across all property types, between January 1 and July 31, 2024 (from $1,258,179 in 2023 to $1,309,596 in 2024).

The number of sales decreased by 4.4 per cent for the same time period (from 16,859 in 2023 to 16,112 in 2024). The number of listings increased by 23 per cent (from 31,052 in 2023 to 38,125 in 2024).

Average sale prices across all property types are anticipated to increase by three per cent for the remainder of 2024, while the number of sales is predicted to also increase by 10 per cent.

The Greater Vancouver housing market is currently experiencing balanced conditions. These conditions will likely persist, with the possibility of shifting toward a seller's market pending further interest rate cuts.

The Greater Vancouver Area is currently oversupplied with plenty of choices for savvy homebuyers and investors looking to jump back into the market early.

The biggest trend transpiring in the Greater Vancouver housing market over the last three months is an increase in “subject-to-sale” offers entering the market again, which is anticipated to continue into the fall. With uncertainty on how fast or how much one can sell their home for, many buyers are opting for the “subject to sale" condition, giving them certainty in their transactions. This is in fact the safest way to move; however, it is a type of offer that is only typically seen for short periods of time.