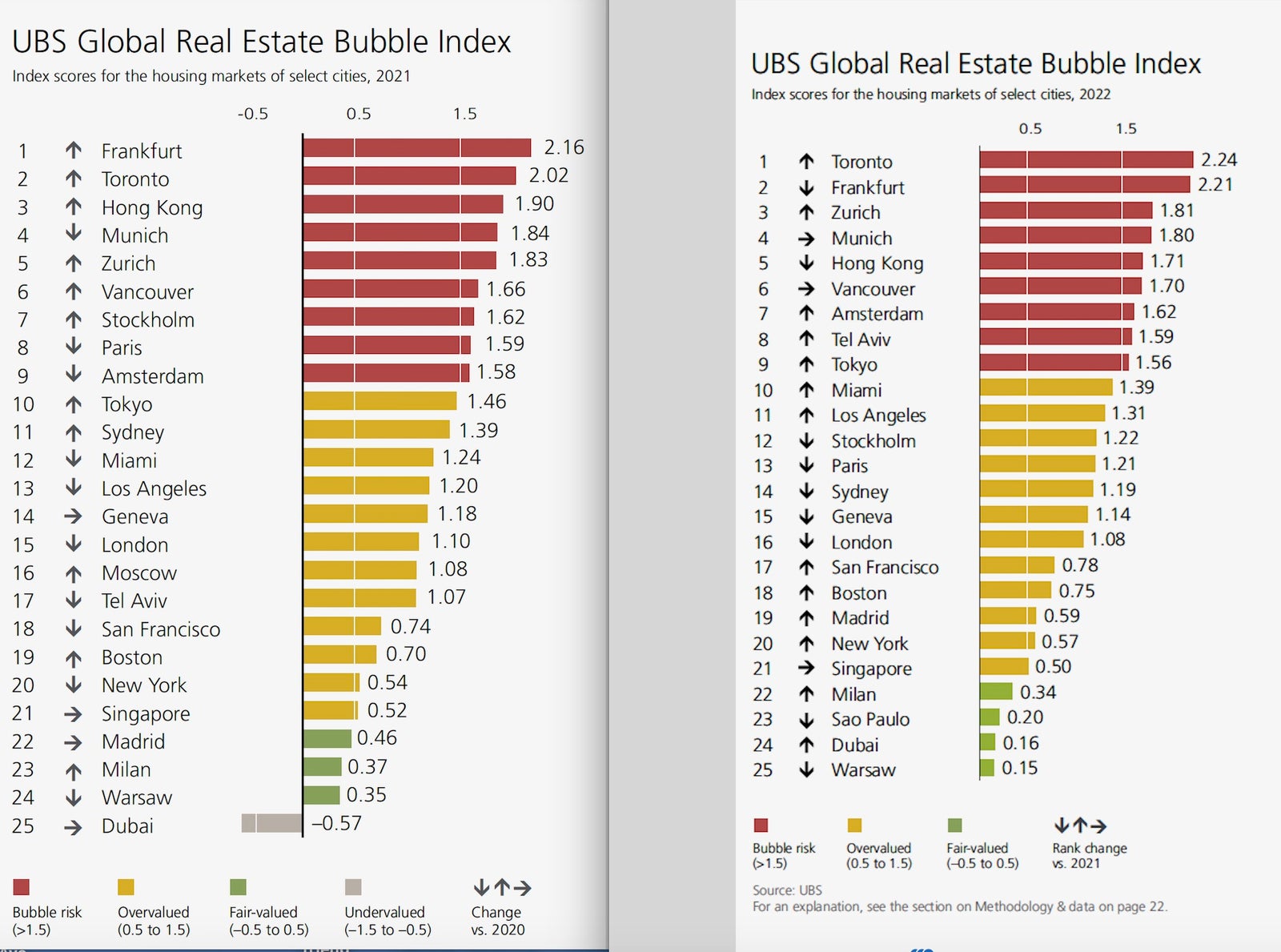

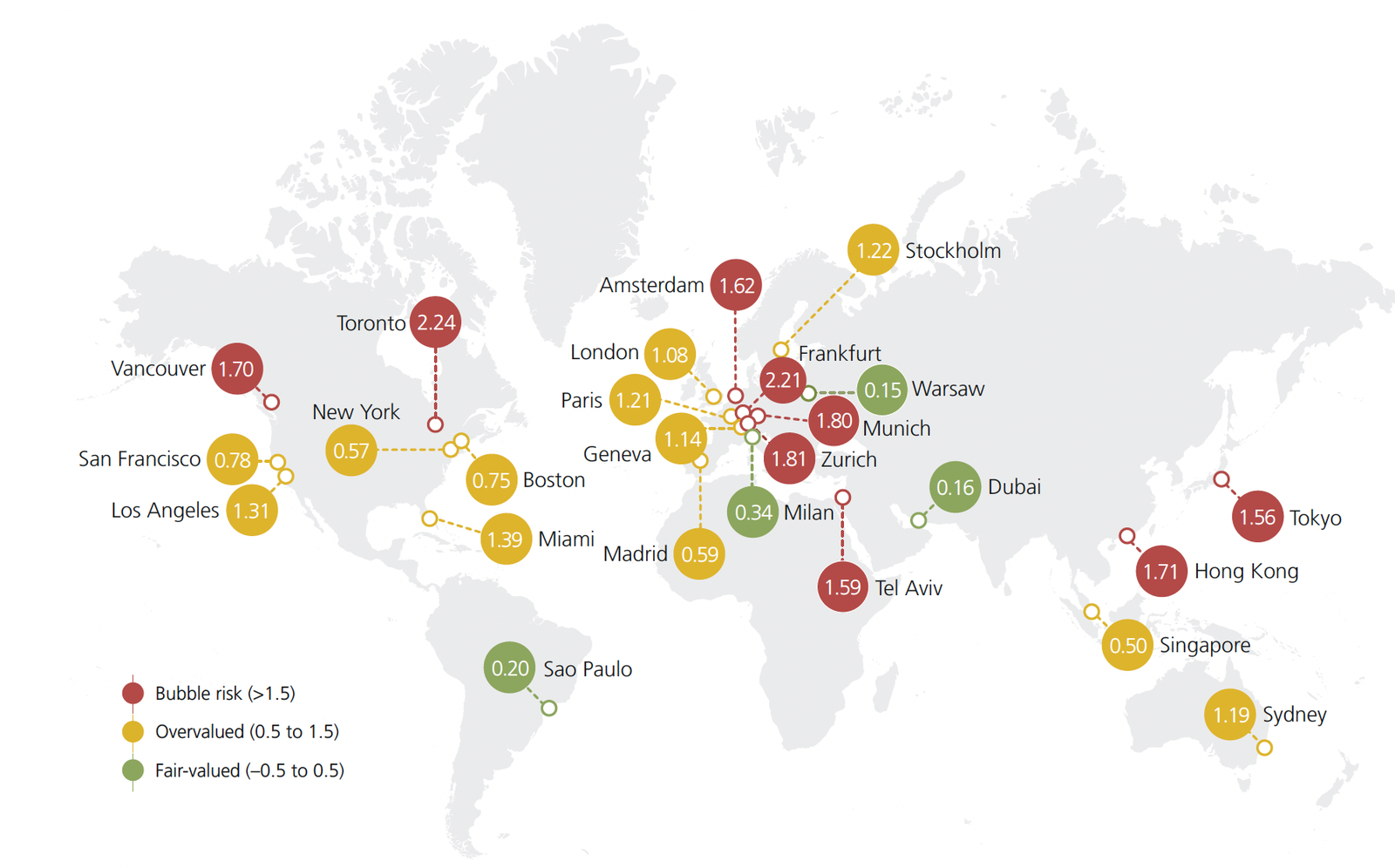

Real house price levels in Vancouver and Toronto have more than tripled in the last 25 years. An urban housing shortage amid strong population growth and falling mortgage rates are typically seen as the two main culprits of the long-term property bonanza in both Canadian cities. High investment demand has also added significantly to the price increases. The index has been flashing warning signals in the last couple of years. The most recent housing frenzy that began in 2019 as mortgage rates fell has continued into 2021. Property price growth in Vancouver and Toronto accelerated to its highest rate in five years, with house prices now respectively 14% and 17% higher than a year ago. Up-sizing during the pandemic on the back of strong income growth has done its part in pushing up demand. Households have also been leveraging up at the fastest pace since before the financial crisis. And although the rental market is running hot with rents climbing by more than double their five-year average rates, they could not keep up with the pace in the owner-occupied market. Bubble risk for both Canadian cities is again highly elevated.