COVID-19 has been affecting many portions of Canada, and one of the major effects of COVID-19 is how it is messing with the real estate market. Canadian real estate market is quite unaffordable, especially Vancouver and Toronto are both very well known for being very expensive cities. RBC, one of Canada’s largest banks, updated their housing affordability data for Q1 2020. In their data they show that overall affordability is worsening, this means that housing required more income during the previous quarter, however, the main reason that affordability was worsening, was nearly entirely due to Ontario, while other regions saw affordability improve. However, Canadian affordability is still on the verge of getting worse.

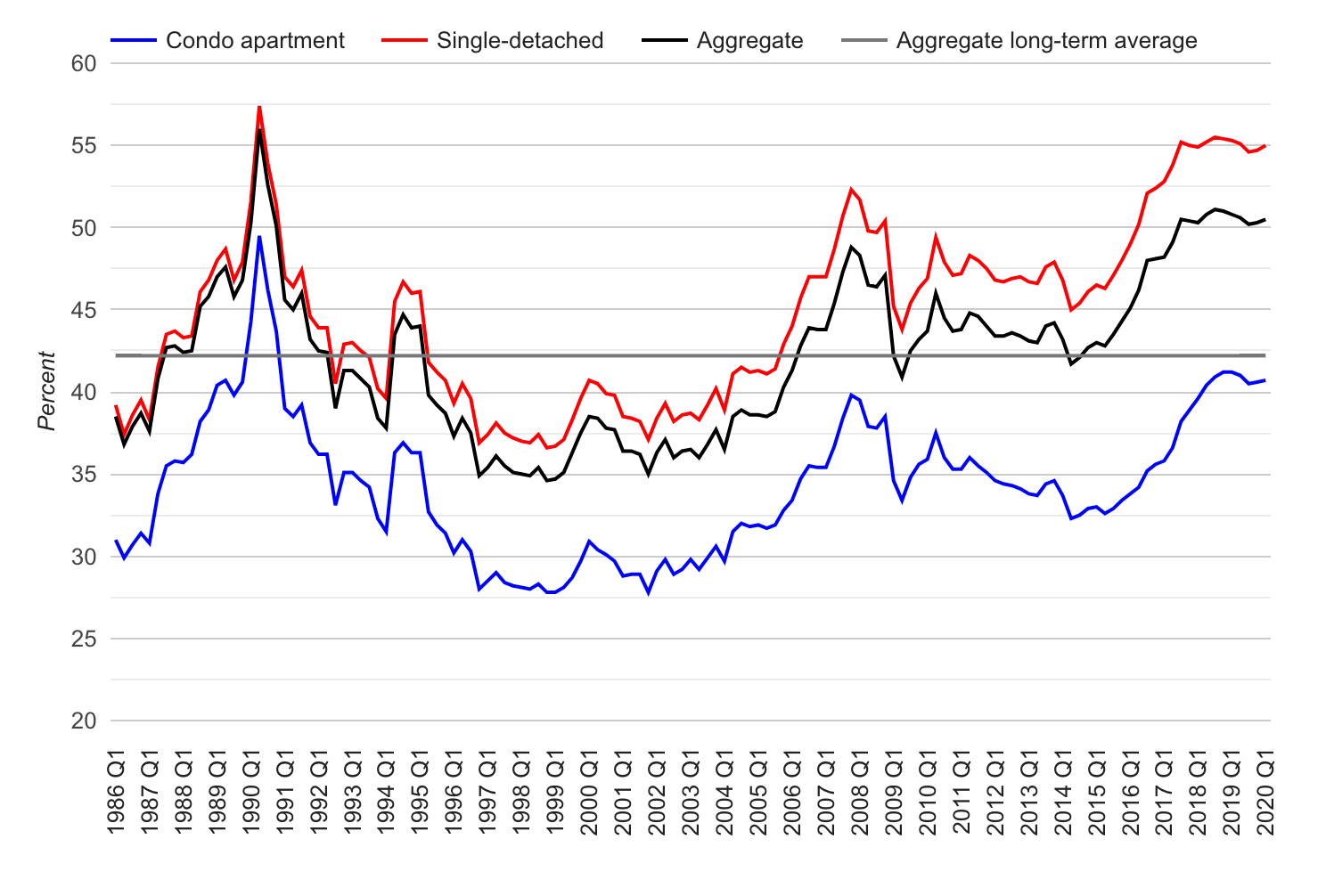

Canadian real estate was slightly more difficult to buy last quarter but without a surprise, it was more affordable year-over-year. The median household would need to spend 50.5 per cent of their income in the first quarter of 2020, up 0.2 points from the previous quarter. This is down 0.3 points from the same quarter last year. This implies housing was 16.43 per cent higher than the long-term average seen in Canada. RBC notes the rise during the pandemic was nearly almost all due to Ontario.

Canadian Real Estate Affordability Index

This chart shows the cost of homeownership as a percentage of the median household income.

Toronto's real estate market:

Currently, Toronto’s real estate has become more expensive, however, it does have a chance at decreasing soon. The median household in Toronto needs to devote 69 per cent of their income as of the first quarter of 2020. This has raised 0.8 per cent from the previous quarter. Year-over-year it is 1.3 per cent higher than in the same quarter. Currently, Toronto is 36.63 per cent more unaffordable than the long-term average, according to the bank. Along with this COVID-19 has dramatically lowered the amount of migration to the country, this will lower demand on houses and prices in the future. Now you may be wondering how is Vancouver’s real estate market doing?

Currently, Vancouver’s real estate market has made the biggest affordability improvement in Canada, it has continued to see an improvement towards its affordability. Due to the constant selling, it is pushing prices lower. The median household now needs 79 per cent of their income in the first quarter of 2020, down 0.3 per cent from the previous quarter. This is down a massive 4.2 per cent from last year which is actually the biggest point drop of any market in Canada. Compared to the long-term average, prices are still 30.57% higher than typically seen. Although Vancouver’s affordability is improving, it is still very difficult to afford. On a side note, one of the other major cities in Canada, Montreal has recently become much more affordable.

Montreal is seeing their affordability improve, the median household needs 43.5 per cent of their income in the first quarter 2020, down 0.2 per cent from the previous quarter. This represents a decline of 0.4 per cent from last year. Housing affordability is 12.98% higher than the long-term average. Although they have not had a drastic change in their affordability Montreal is still a much more viable option for a home instead of Vancouver and Toronto for the average family as its average prices are much cheaper.

RBC warns that this recovery from COVID-19 will be a “long and bumpy road”, due to significant factors such as immigration and unemployment. However, they also stated that “We expect moderately lower home prices and exceptionally low-interest rates to reduce homeownership costs in the period ahead.”

If you would like to learn more about how affordability has changed in these three major cities in Canada, or if you are thinking about buying or selling your properties, please contact Matt Gul, who is a top luxury real estate agent situated in West Vancouver, who can help you with all of your needs. To contact Matt Gul please call him at 778.888.8888 or email him at matt@mattgul.com

Summarized by: Onur Gul on Instagram at @onurgulfilm